How to Safely Accept and Make Transactions in the Current Payments Compliance Landscape

Here are the main regulations that govern payments, what they control, and who enforces them.

At first glance, processing transactions as a business is as simple as plugging in a payment processing solution, connecting it with your bank accounts, and following common sense security and privacy rules.

It’s partly true – the bulk of the regulatory compliance burden is passed to your bank and payment processing provider. And yet, as someone who is accepting payins and making payouts, you are also of interest to a number of regulating bodies.

Staying compliant with domestic laws is enough of a challenge. But if you need to make and receive payments internationally, the number of regulations quickly increases.

As a business owner working with payments digitally, you need to be aware of your direct responsibilities and governing bodies, which keep a watchful eye over who you do business with and how you process payments.

In this article, we’ll go over the USA’s payment regulatory framework and break down the responsibilities and roles involved in this process.

Main regulations that govern payin and payout transactions in the USA

Depending on your business domain and location, you may have some specialized payment regulations. This is particularly true for credit, gambling, real estate, healthcare, and a few other industries.

But for most product or service providers, here are the main regulations that govern payments, what they control, and who enforces them.

- Bank Secrecy Act (BSA) is the cornerstone anti-money laundering regulation in the USA. Enforced by the Department of the Treasury, it requires banks and payment processors to find and report transactions that flag money laundering and tax evasion checks.

- Customer Identification Program (CIP) – before the transaction happens, we need to verify the customer’s identity and check if they are on any watchlists or sanctions lists. This is part of the PATRIOT Act that requires banks, payment processors, and other financial institutions to gather and verify the personal information of anyone using their services.

- Countering the Financing of Terrorism (CFT) – several federal agencies, including the Financial Crimes Enforcement Network, Department of Justice, and the Treasury, control the measures banks and payment processors take to find, prevent, and report payments linked to terrorism.

- Electronic Fund Transfer Act (EFTA) – regulates all wire transfers, deposits, and withdrawals, ATMs, point-of-sale terminals, and electronic payments. It requires the involved parties to create a secure environment, including encryption, access control measures, network monitoring, and testing. The primary enforcement body for EFTA is the Consumer Financial Protection Bureau (CFPB).

- The Office of Foreign Assets Control (OFAC) requires businesses to screen all their customers against the current Specially Designated Nationals (SDN) list before processing the payment.

- Payment Card Industry Data Security Standard (PCI DSS) – applies only to card-related payments and regulates data encryption, data storage, and network security for both incoming and outgoing transactions. The standard applies to merchants, banks, and payment processors. It is formed and maintained by Visa, Mastercard, American Express, Discover, and JCB. However, the Federal Trade Commission, the Federal Reserve, and the Comptroller of the Currency enforce similar standards nationwide.

What are your regulatory responsibilities?

Even though regulations differ by country, as a business that makes and accepts payments, your compliance responsibilities will be very similar in most developed economies.

Most of the obligations you have in the eyes of the regulators can and should be taken into account automatically by your bank or payment processor.

Your role primarily involves collecting and securing customer payment and contact information, following the guidelines set by your processor, maintaining basic cybersecurity practices, and filing currency and suspicious activity reports.

If you work with business transactions, these are your key responsibilities in terms of payment compliance.

- Run AML and KYC checks

Regularly monitor transactions to identify irregularities that the payment processor may not have caught.

- Train your staff

Ensure your employees know what data they need to get from a customer before processing a transaction.

- Ensure data protection

For card-related transactions, your technological infrastructure needs to adhere to PCI DSS by providing sufficient security measures.

- Report suspicious activity

Implement customer due diligence (CDD) and enhanced due diligence (EDD) processes to use for high-risk customers. Report any suspicious activity (transaction size, frequency, location, etc.) by filing a Suspicious Activity Report (SAR),

- Disclose large cash transactions

Complete and submit Currency Transaction Reports (CTR) for cash transactions over $10,000.

Organization’s AML and KYC compliance checklist for payments

The good news is that payment regulators aren’t out there to get you. What they want is for you to pick who you work with carefully and to be ready to provide the transaction information you processed.

So, in simple terms, here’s your checklist with items you, as a business, need to take care of before you start processing payments.

- Verify customer identities

- Monitor transactions

- Protect customer data

- Implement anti-money laundering procedures

- Train staff

- Maintain records of customer and transaction data

- Report suspicious activities

- Ensure compliance of payment processor

How is payment compliance enforced for business owners?

In the USA, business entities are monitored for compliance with the regulations we listed before by several key agencies and sometimes state or industry bodies.

Here are the agencies that enforce key USA payment regulations and work directly with businesses:

- The Federal Trade Commission (FTC)

- Consumer Financial Protection Bureau (CFPB)

- Payment Card Industry Security Standards Council (PCI SSC)

- Office of Foreign Assets Control (OFAC)

- Financial Crimes Enforcement Network (FinCEN)

On-site examinations are usually reserved for large corporations and stand-out cases. Most compliance is done via questionnaires and submission of records to the regulating body.

These and other state or federal agencies can send you a letter indicating what data they want to analyze. This can include your AML procedures, policies, documentation, transaction records, or other customer due diligence documentation that ensures compliance with consumer protection laws.

If the payment processor flags a transaction as suspicious, they will contact you with instructions on what additional documentation is needed for enhanced due diligence. Usually, it’s customer identification (TIN, SSN), proof of address, or additional details about the transaction.

Identify the regulating bodies of your payments

Compliance is a layered process, and every regulating body carries out its own governance that often overlaps. At the same time, if an organization fails to prevent, identify, and report suspicious transactions, they may be held responsible and penalized monetarily or through stricter controls.

That’s why it is important to stay on the safe side and research regulations that apply to you in particular. To do that, other than doing your own research, you may need to:

- consult with your payment processor and bank

- consult with a relevant local trade association

- look into your state’s payment regulation.

Choosing a compliant payment processing provider

When building out your digital payment infrastructure, the challenges come from two diametral positions:

- The imminent threat of cybercrime that specifically targets businesses with a subpar technological stack.

- National and international regulators that enforce compliance with the payment management laws on business owners.

To simplify compliance, you need a payment processing provider that makes your life easier by informing you of what regulators expect of you and taking all the remaining details upon themselves.

Here’s what you should look for when evaluating payment processors.

- Payment gateways compliant with PCI DSS

- Compliance with necessary domestic and international AML and KYC laws

- Automatic transaction monitoring rules

- High-risk transactions limiting

- Additional KYC for high-value or age-restricted products

- Customer data encryption

- Security features - encryption, data protection, fraud prevention and detection, 2-factor authentication

- Relevant certifications

- Experience in your industry

Payment compliance with Payment Labs

In our experience, businesses expect to make and accept payments domestically and internationally from the same interface with the same ease and speed and without excessive fees.

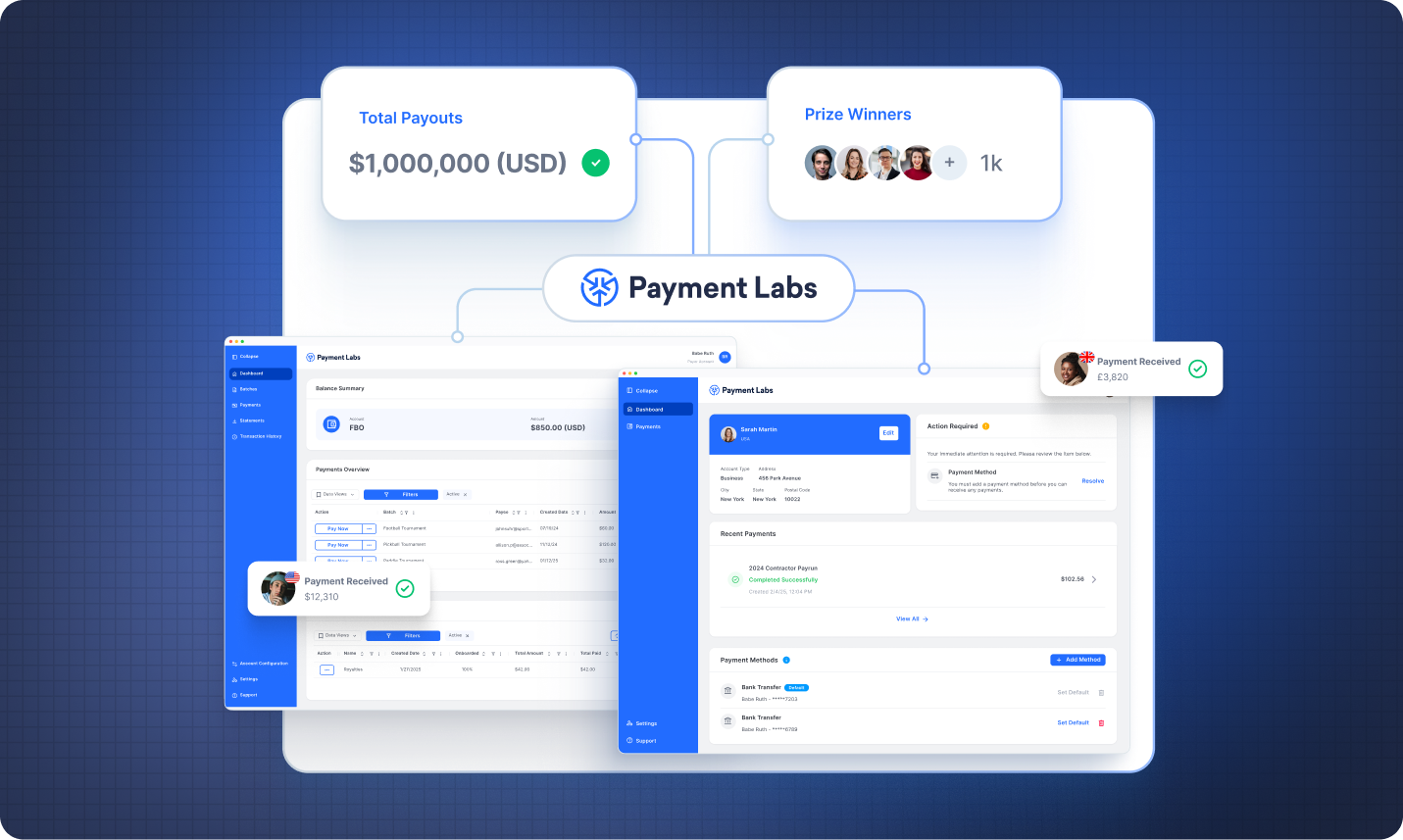

And that is exactly what we’ve done with the Payment Labs payment processing solution.

Our clients in sports, esports, the creator economy, and other industries make and receive compliant payments to and from 180+ countries, which is proving to be an important differentiator for them. Payment Labs is SOC 2 Type II certified and ensures secure transactions and tax-ready reporting in all major jurisdiction. Whether you work with contractors, athletes, prize money winners, gig workers, or content creators, the platform can pay anyone in a straightforward and compliant way, allowing you to focus on business development instead of regulations.

Let’s discuss your payment processing needs and resolve any payment problems you may have. Schedule a call with our team to get started with Payment Labs!