Three Reasons to use a Payment Processor

Processing payments for employees and vendors can be cumbersome, complicated, and incredibly time-consuming for accounting teams.

Processing payments for employees and vendors can be cumbersome, complicated, and incredibly time-consuming for accounting teams. The process only becomes more challenging as businesses grow – often requiring an investment of additional resources to issue payments and ensure tax compliance – locally, nationally, and around the globe.

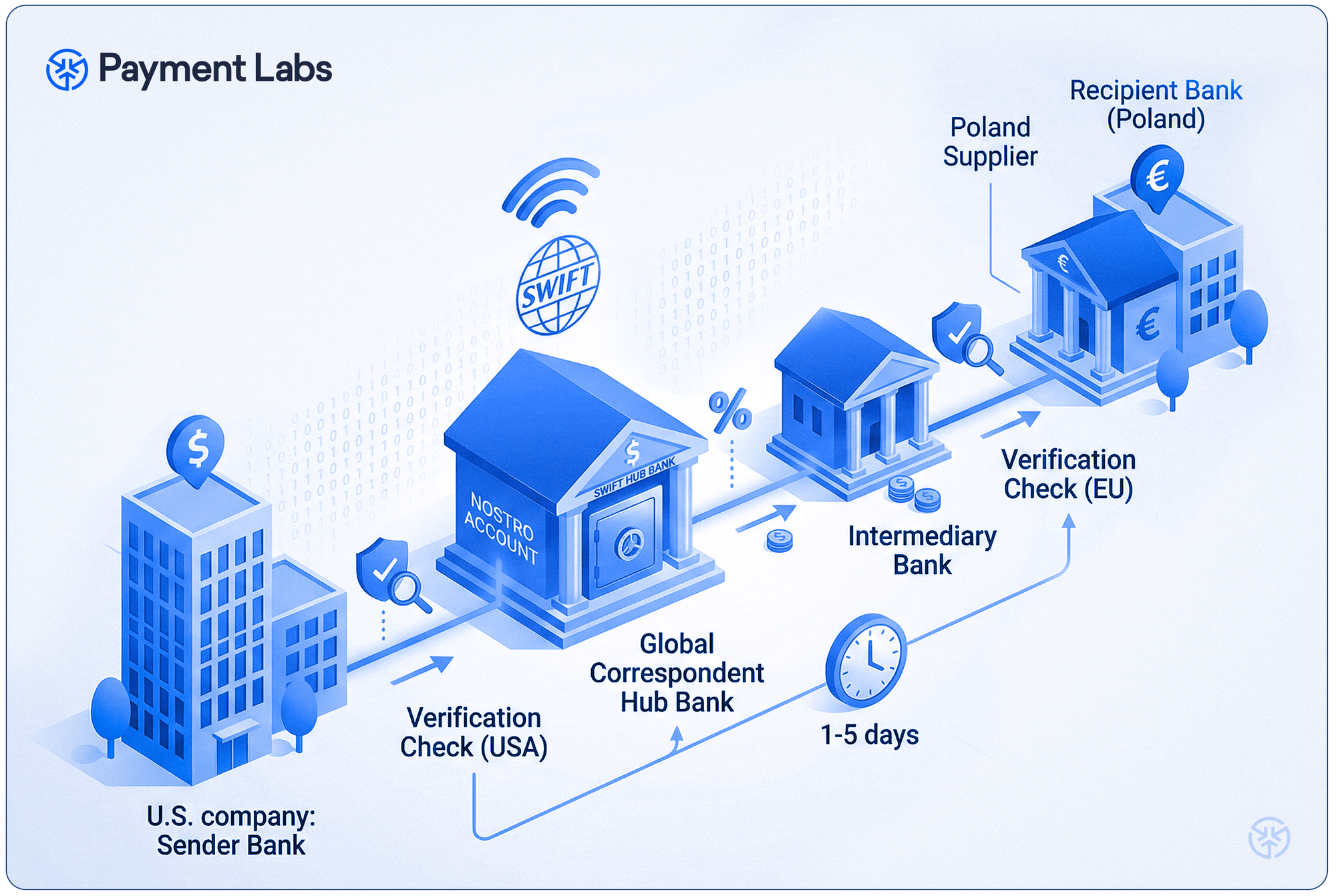

A payment processor is an external vendor that manages the logistics of payments. Payment processors bridge the gap between individuals and financial institutions by transferring payment data from whatever point customers enter their payment details (bank account, wallet, 3rd party payment processor accounts) and the various financial institutions that participate in the transaction.

But why should you use a payment processor instead of sending a check through your accounting team?

1. Faster Payments

Most companies have a standard process for paying employees. They have the tools in place to run payroll. Accounting teams have a regular pay schedule set in place. And they have funds set aside for employee benefit programs. However, the ever expanding digital economy has upended the traditional payment system, often creating chaos for small and medium-sized businesses. These payment recipients are not typically paid a set amount on a regular schedule. Instead, they are issued payment when a project is complete. This creates extra workload and headaches for companies or individuals paying gig workers.

When gig workers and freelancers don’t get paid quickly, it strains the relationship and can lead them to look elsewhere for work. A payment processor streamlines and expedites the payout process and keeps the cash flowing into the bank accounts of gig workers and freelancers, which ultimately reduces the rate of turnover.

2. Tax compliance and risk mitigation

When companies issue payments to third parties, they face considerable tax and financial liabilities, which creates the risk of future audits. Many organizations do not have the significant resources required to ensure compliance with every one-time payment.

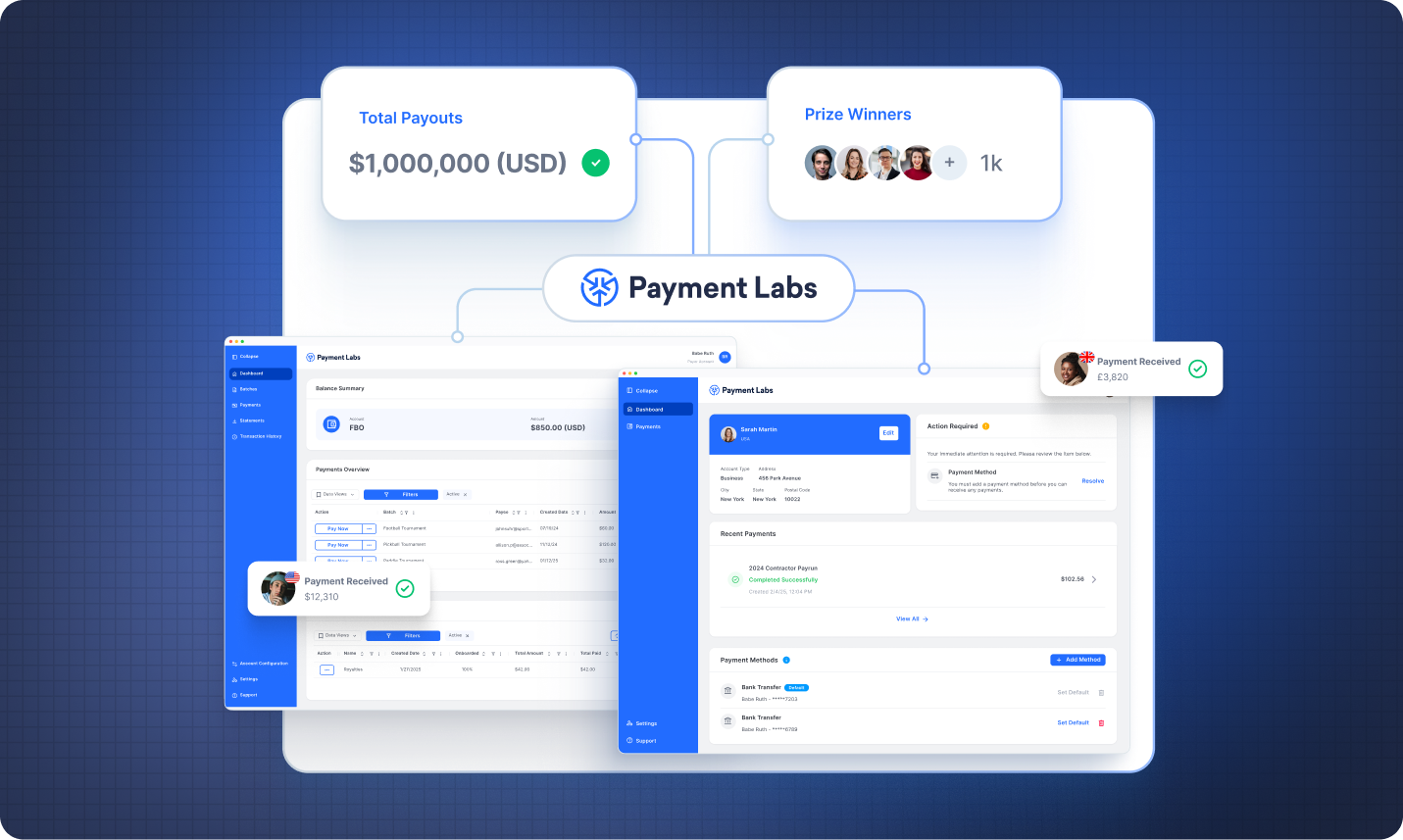

Payment processors, such as Payment Labs, take this regulatory burden off their hands by managing tax compliance. This means no more sleepless nights for accounting teams spent worrying about the status of their company’s payments. These processors ensure that their payments are safe, secure, and compliant with all national and international banking regulations.

Online processors also help eliminate the risk involved with traditional payment methods, such as check washing. Payment processors provide transparency – removing the doubts individuals and businesses often have when it comes to sending or receiving paper checks.

3. Streamlined international payments

Paying individuals across the globe creates significant pain points. The transfer and exchange fees are significant. Regulations vary from country to country. Security issues skyrocket with international transfers.

Companies can address these challenges with a payment processor. Payment Labs operates across national boundaries and currencies, safely and securely sending funds to even the most difficult-to-reach payees. We make it easy to compensate payees regardless of location, currency used, or local bank access.

Whether you own and operate a small business, manage the accounting team of a large corporation, or are an individual looking to pay freelance workers, using a payment processor can help you quickly and efficiently help you issue payments.